We’ve been doing a deep dive on the current state of American chip manufacturing, which, if you’ve been paying attention to the news lately, seems pretty bleak.

Chips aren’t just components anymore. They’re _infrastructure_. They shape everything from global GDP to national security to whether your iPhone even turns on in the morning.

And yet the United States — the country that _invented_ the microchip — can no longer reliably manufacture the most advanced ones.

**But then I came across an article about how not a startup, but an older, more established company might be the key to saving American chip manufacturing.**

That company is Intel.

> _But first! A word from our sponsor:_

> Our video is sponsored by SBS Comms — a PR firm that doesn’t wait for permission. They’re built for frontier tech, chasing big, messy, high-stakes ideas with straight talk and real results. If you’re building something that actually matters, they’re the team you want in your corner.

>

### Three Options for an “American TSMC”

If you haven’t noticed, there are chips in a lot of things these days– almost everything. And there’s been a lot of discussion around America’s dependence on the Taiwan Semiconductor Manufacturing Company, otherwise known as TSMC, especially in today’s gold rush of AI.

**If China were to take Taiwan, and thereby TSMC, military experts typically agree that the** [**opening chess moves of a military conflict over Taiwan would be about one thing: speed**](https://ipdefenseforum.com/2024/07/swarming-drone-hellscape-to-deter-prc-use-of-force-against-taiwan/?utm_source=chatgpt.com)**.**

This would be a war fought, ironically, with a lot of chips. [Precision missiles, satellites, and drones all run on advanced semiconductors](https://www.govinfo.gov/content/pkg/GOVPUB-D-PURL-gpo183614/pdf/GOVPUB-D-PURL-gpo183614.pdf?utm_source=chatgpt.com). Clearly, this is something we need to be paying attention to.

And it’s something that Contrary Research has been diving deep into. So we talked to [Kyle Harrison](https://x.com/kwharrison13?lang=en) about their recent article, [_Chips for America, Building an American TSMC_](https://research.contrary.com/deep-dive/building-an-american-tsmc)_._

> We started out by looking at new ways of building semiconductors, whether that’s new architecture, if that’s AI specific chips, or it’s fundamentally different types of computing.

>

> _Kyle_

So what options do we have to bolster and protect American chip manufacturing capability?

**Option one: support a startup to build an American foundry from the ground up.**

_But how realistic is that?_

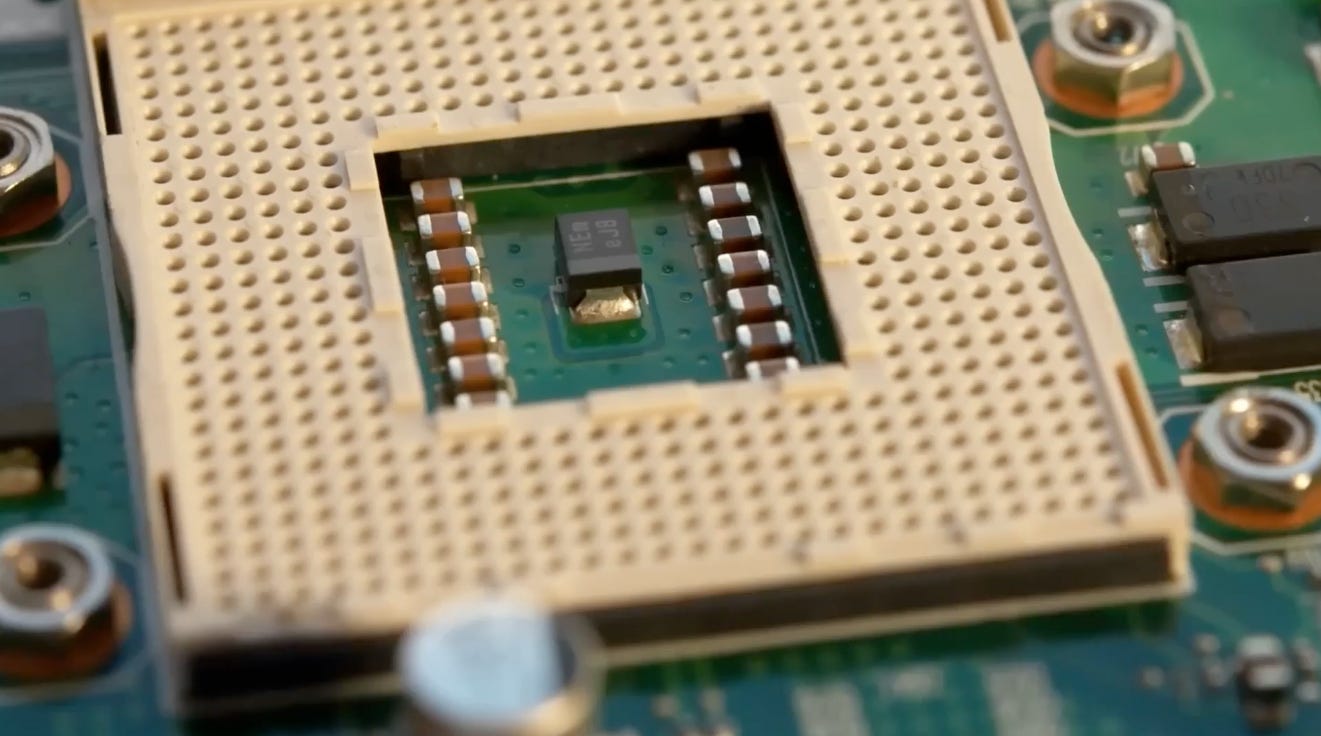

> Can we build it from scratch? And it’s like, well, there’s something that’s called Rock’s Law, which is coined by Arthur Rock, where it’s basically this idea that the cost of a semiconductor fab will double every four years. And that’s largely been true.

>

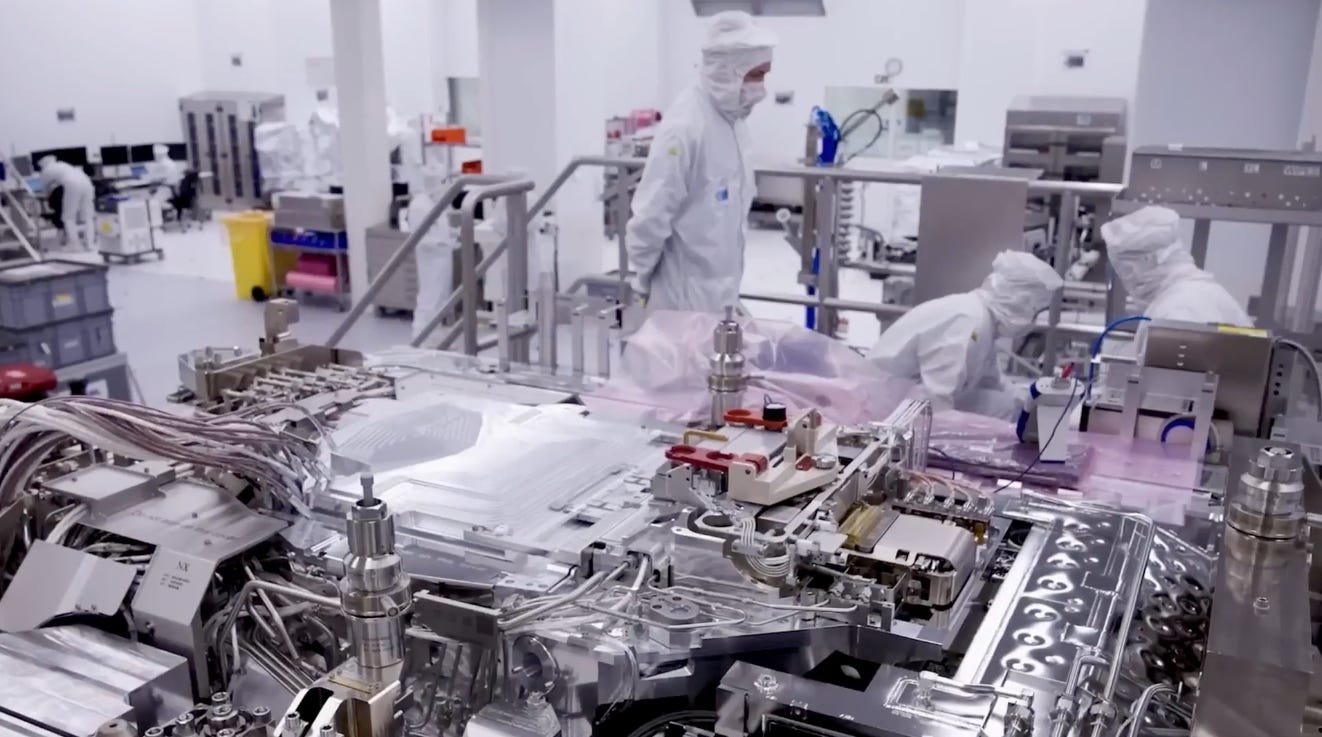

> It’s exorbitantly expensive. So it’s maybe $20 to $30 billion just to turn the lights on. And that’s things that are really complex, like literally the most complex things that humans have figured out how to do. Technology like EUV, like these are machines that can cost $300 or $400 million a pop. Clean rooms that are a thousand times cleaner than a typical surgical suite. So building it from scratch is really difficult. There’s no startup that’s going to go out and raise a $30 billion seed round just to build a fab so that they can then raise a $20 billion Series A to be able to go try and put it to work. It’s just not going to happen.

>

> _Kyle_

America once made nearly all of the world’s chips, but over the last few decades, that expertise drifted overseas. Today, tens of thousands of jobs in chip manufacturing are sitting empty.

It’s a little embarrassing, honestly, that chip was born in America, and now we don’t even know how to make them.

**And that brings us to option two: theoretically, we could “borrow” TSMC.**

But protecting Taiwan to keep it independent is complicated. A recent estimate by the Institute for Economics and Peace projected that a full-scale war over Taiwan could [cost the global economy more than $10 trillion](https://hcss.nl/wp-content/uploads/2024/03/Taiwan-The-Cost-of-conflict-HCSS-2024.pdf?utm_source=chatgpt.com), far eclipsing the economic damage from the Ukraine war. Even a more limited Chinese blockade of Taiwan could cause a [2.8% drop in global GDP in the first year alone](https://www.economicsandpeace.org/wp-content/uploads/2023/09/GPI-2023-Web.pdf?utm_source=chatgpt.com). And let’s not forget all the people that would be dying over chips.

But good news! TSMC is already coming to America— Arizona specifically, just north of Phoenix. [They have just completed building the most advanced chip fab on U.S. soil, a 3.5 million square foot building with some 2,000 employees, and a plan to produce four nanometer chips at a rate of 20,000 wafers per month.](https://www.reuters.com/technology/tsmc-begins-producing-4-nanometer-chips-arizona-raimondo-says-2025-01-10/?utm_source=chatgpt.com) And Apple has already signed on as its biggest customer.

_But will it be enough?_

> When you look at Taiwan and their sort of reaction to TSMC’s investments in Arizona, they’re very deliberate about not wanting that cutting edge capability to be exported to the U.S. But the reality is that to get access to cutting edge research, Taiwan is very protective of keeping that in Taiwan.

>

> They call it their silicon shield. They believe that the reason they’ve been protected from a Chinese invasion is because the U.S. and other countries are so dependent on Taiwan for semiconductors. So the Taiwanese government is very deliberate about making sure that quality of the research and production that’s getting outsourced to those plants, they’re trying to keep it as far away from the cutting edge as possible, while still not feeling like they’re taking away from what they promised the U.S. So while we can get a lot from TSMC, getting to that cutting edge capability, Taiwan is heavily incentivized to make sure that we don’t get that.

>

> _Kyle_

Semiconductors were invented and innovated on in America, but we gave it away. What’s the story there?

> That’s what happened in Asia, where we were manufacturing so many of our chips that the cost curve changed. You already had way lower cost of labor. You add on to that, that you’re giving them the vast majority of our volume, they’re going to get so much more effective at manufacturing chips. And then eventually it gets to the point where we literally don’t have that capability internally. So it’s like, OK, where in the U.S. can we go to buy cutting edge chip capability? And literally, I kid you not, the only option is Intel.

>

> _Kyle_

**So– we might have a third option: investing in an existing company and turning that into the American foundry that we so desperately need.**

> There’s a great quote from the original founder of AMD where he said, real men have fabs. We build chips ourselves. Basically, everybody has given up on that.

>

> _Kyle_

_Wait– but why is that?_ Why did we give it all away?

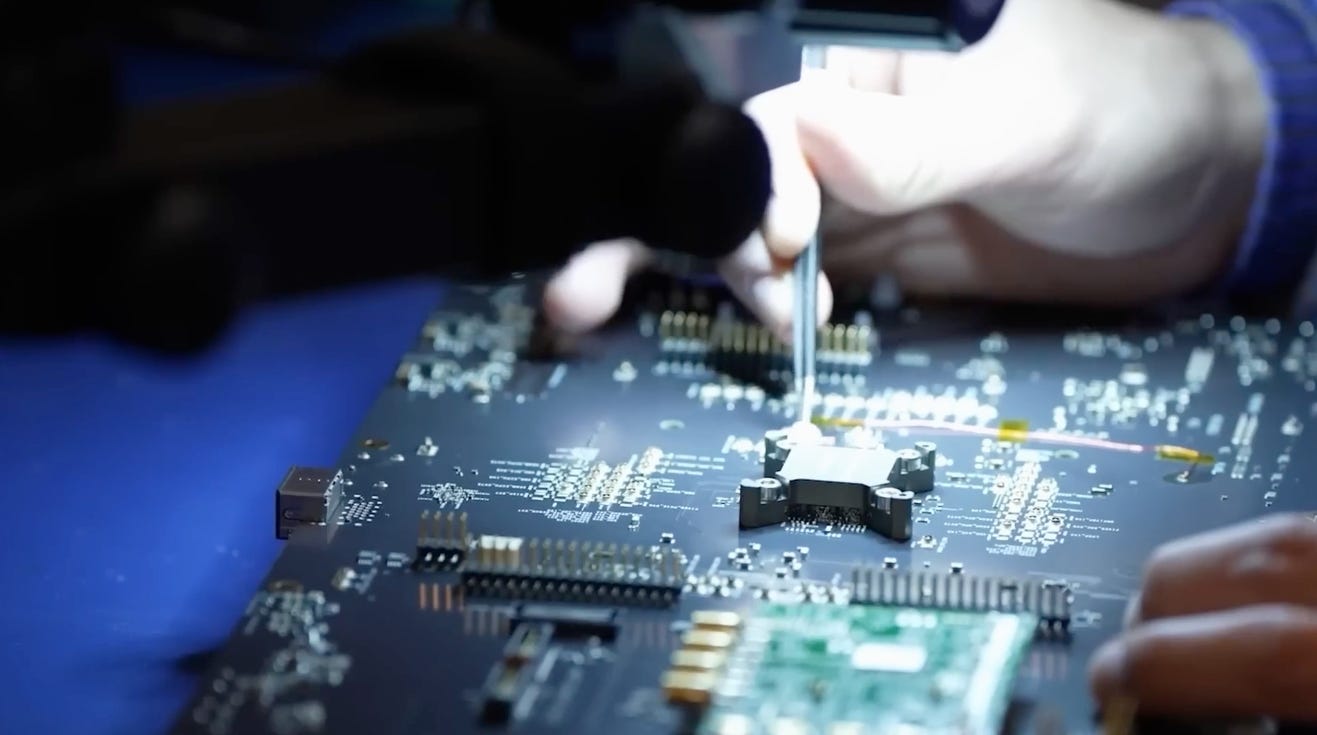

To answer that, let’s look at the complexity of building a single chip.

The first ICs had around 10 transistors. [The NVIDIA Blackwell from 2024 has 208 billion transistors](https://nvidianews.nvidia.com/news/nvidia-blackwell-platform-arrives-to-power-a-new-era-of-computing?utm_source=chatgpt.com). That’s roughly a 10 billion fold increase in transistor count over 60 years. The chip today has 10 billion times more transistors than the first one did.

Basically, as transistor sizes keep shrinking, they become exponentially more complex and expensive to manufacture. The prevailing belief was that the US could focus on chip design and higher level R&D while letting cheaper overseas foundries handle the low-skill manufacturing work, which has been a common theme for manufacturing over the past two decades.

_OK, back to Kyle._

> And so when we stepped back to think about what is the most important element for us to drill into and really understand, it was, what are we going to do about this sort of double-edged sword? If there is a private market solution, if there is a startup that can make a dent in the problem that we have articulated, what is it? And we went and looked at all the different elements. And that’s when we kind of realized the private companies that are making a huge difference because they are a critical element of the next 20 years of sort of semiconductor evolution. But the reality is that the specific problem statement that we’ve laid out is probably not going to play out over the next 20 years. It’s probably going to play out over the next, call it, four or five years. And so in that very short time window, we have to get to scale very quickly. And so then we start looking at the solutions.

>

> And then we went through the options of like, OK, if it’s not startups, is it TSMC? Is it Samsung? We eventually got to Intel.

>

> _Kyle_

### The Intel Story

[Intel was founded in 1968 by Robert Noyce and Gordon Moore](https://www.intel.com/content/www/us/en/history/virtual-vault/articles/intels-founding.html?utm_source=chatgpt.com), who, along with Andy Grove, built it into the company that powered the personal computing revolution.

After [inventing the microprocessor in 1971 and winning the IBM PC in 1981](https://www.intel.com/content/www/us/en/history/virtual-vault/articles/the-8086-and-the-ibm-pc.html?utm_source=chatgpt.com), Intel became the dominant force in computing by locking in the x86 standard and perfecting advanced semiconductor manufacturing.

Intel relentlessly drove Moore’s law forward. By 2011, it was the [first to mass produce 22 nanometer chips using 3D transistors](https://www.intc.com/news-events/press-releases/detail/655/intel-reinvents-transistors-using-new-3-d-structure?utm_source=chatgpt.com).

_So what happened?_

**Well, in the** [**words of legendary Intel CEO Andy Grove**](https://www.bloomberg.com/news/articles/2010-07-01/andy-grove-how-america-can-create-jobs?utm_source=chatgpt.com)**, “Not only did we lose an untold number of jobs, but we broke the chain of experience that is so important in technological evolution.”**

In the 2010s, Intel stumbled, missing the mobile revolution when it lost the Apple iPhone chip contract to ARM-based designs. It fell behind Taiwan’s TSMC and Samsung in chip manufacturing at the 10 nanometer and 7 nanometer scale. And today, Intel has lost ground to NVIDIA and AMD in the AI chip surge.

Even Apple is no longer using Intel Silicon. [Since 2016, TMC has produced all of Apple’s chips from their own designs](https://www.eetimes.com/tsmc-wins-all-apples-a10-chip-business-report-says/?utm_source=chatgpt.com). Beyond these technical missed opportunities, Intel also suffered from a cultural shift.

Over time, the company moved away from its engineer-led roots, the kind of culture Andy Grove built, toward a management-driven one. **And some say that change led to complacency and slower execution, a lack of technical rigor.**

### But Intel Is Still A Giant

**Despite its decline, Intel remains uniquely important today.**

It is the only American company still capable of manufacturing advanced chips domestically at scale. Before 2021, Intel only manufactured chips that it designed itself. The launch of the Intel Foundry services marked a major strategic shift.

Intel now builds chips for other companies and competes directly with TSMC and Samsung in the contract manufacturing business.

Today, Intel has [15 wafer labs in production worldwide at 10 locations](https://www.intel.com/content/www/us/en/support/articles/000089875/programs/intel-corporation.html?utm_source=chatgpt.com). Production sites include Chandler, Arizona, Rio Rancho, New Mexico, and Hillsborough, Oregon.

The [Global Wafer Capacity Report from 2024](https://www.eetimes.com/five-chip-companies-hold-53-of-global-wafer-capacity/?utm_source=chatgpt.com) notes Intel’s production was 817,000 wafers per month. A single 300mm wafer can produce anywhere from 100 large high-end CPUs, if every chip is big like a server processor, up to several thousand small chips like microcontrollers or power chips. But as of 2019, Samsung’s capacity is at around 2.9 million equivalent wafers per month, and TSMC trails just shortly behind at 2.5 million wafers per month.

> Over time, they’ve had four different leaders over the course of four years. And that title has gone from president of Intel Foundry to the general manager of Intel Foundry. And he’s also, I think, the CTO of Intel more broadly, and the chief global supply chain officer or something.

>

> It’s very clear that, yeah, he’s the leader of Intel Foundry, but he’s clearly not the buck stops with him, first visionary leader, full force energy. And even Intel Products has a CEO of Intel Products. Why is there not a CEO of Intel Foundry? Why are they not leading with a vision of what they can accomplish? Those are the fundamental things that Intel needs to change.

>

> And until that happens, things like the CHIPS Act, it’s like you can pour money into a problematic engine, but you’re not going to get out better results just because they have more capital flowing to the top of the funnel. You really have to unpack the pieces and solve the problems before you can then invest in capability. But Intel is so close. It’s in the piece we map out sort of when they’ve launched different nanometer scales of chips, and they’re the only one that’s still... The fight is not over. It’s not like they’re multiple generations behind. There’s three core components of Intel that need to be dealt with.

>

> So the first thing is that Intel went through a pretty massive transition from engineering to managerial leadership. It was in 2005, they had their first CEO who was not an engineer by training. And then they basically went through about 15 years of financialization.

>

> This was literally the peak of stakeholder capitalism of maximizing shareholder value and massive stock buybacks and financial engineering. Very little focus on maintaining cutting edge engineering capability. When Pat Gelsinger joined as CEO, he really emphasized this idea of we need to bring back the geeks.

>

> We need to put engineering back as the sort of core focal point of the company. And while that happened, slowly but surely did build back a bigger focus on engineering culture. There was also the element of that they needed to be able to incentivize their teams and systems and things like that to really focus on high quality output more so than things like profitability.

>

> And that brings you to the second point, which is Intel has not only a business model and mentality and a board, but also an investor base in the public markets that is very, very focused on short-term earnings optimization. They spent 15 years curating that investor base to solve for how can we make sure that Intel is as profitable as they possibly can be. When they started to break out Intel Foundry as a separate P&L, people realized, man, that just how much Intel Foundry was kind of a loss leader for them.

>

> And there were literally activist investor lawsuits against the board, believing that they had misled them about the health of Intel because they had kind of obfuscated how much money the Foundry cost. And so it’s fundamentally the wrong investor base. But even if you change the culture, even if you change the investor base to really focus on the sort of growth and innovation over cost optimization, you still end up with this core problem where there is not visionary leadership at the company.

>

> _Kyle_

U.S. policymakers have begun directing support its way.

For example, [Intel secured up to $7.86 billion in CHIPS Act funding for a new set of fabs in R&D,](https://newsroom.intel.com/corporate/intel-chips-act?utm_source=chatgpt.com) plus about [$3 billion in DoD contracts](https://newsroom.intel.com/corporate/2024-intel-news?utm_source=chatgpt.com) under a program called Rapid Assured Microelectronics Prototypes, or RAMP, sometimes dubbed the Secure Enclave to Produce Chips for Defense.

**The government is also investing in a bunch of different options for the CHIPS Act, and there’s an argument to be made for diversifying our efforts.**

What about a newer, maybe faster company– albeit that doesn’t fab, but knows a bit about it, that has 40 times the market cap Intel does: NVIDIA?

They certainly could afford it. And compared to anyone else other than Intel, they seem like the most well-positioned company to even think about doing this.

> I think absolutely there is a world where NVIDIA could do this. There is a core dependency that they also have on TSMC that is problematic for them. There’s a lot of geopolitical problems for them in terms of the dependence that they have, not only on TSMC as a manufacturer, but China as an end market.

>

> There’s a bunch of complexity that gets solved if NVIDIA was producing its own chips. Whatever it is, whatever process we take to be able to give Intel the things that it needs to be America’s foundry that we need it to be. I’m open to any of those things. I’m not here to say, hey, I think it’s got to be these folks and not these folks. It’s got to be this money and not that money. There’s a lot of pros and cons to a lot of different approaches. So I don’t think that we’re necessarily trying to say this is the only path forward for doing this, but more so these are the things that need to happen in order to make this American foundry possible. The reason that AI is so critical is not just because it’s great and we all want better chatbots, but it’s because in the pursuit of something like AGI, as AI gets better and better, its ability to then turn around and support us in the pursuit of even better AI, it all compounds. And if we get cut off from the access to cutting edge AI, then we get cut off from the future.

>

> That’s why this is so critical. It’s not just because we want to pick another fight over a commodity that we’re all excited about financializing. It’s because it is a fundamental element for any of us to continue to build the future.

>

> _Kyle_

When you zoom out, this isn’t really a story about fabs or wafers or nanometers. _It’s a story about whether a country can remember how to build._

For decades, America treated manufacturing like something we could outsource — a solved problem, a relic of an older world. It turns out that the most advanced technologies we dream about — AGI, autonomous systems, hypersonic defense, clean energy, new medicines — all sit on top of a physical foundation. And that foundation is silicon.

**If we can’t make it, we can’t shape what comes next.**

But the hopeful part is this: nothing about our current trajectory is inevitable. Capability can be rebuilt. Expertise can be relearned. Companies can reinvent themselves. Nations can decide to take back responsibility for the things that matter most.

_Intel’s story isn’t finished. Neither is America’s._

We are living through a moment where the decisions we make — about engineering, about leadership, about what we choose to build — will ripple for decades. And if we get this right, we’ll look back on this period not as the moment we lost our edge, but as the moment we chose to reclaim it.

_Until next time, keep on building the future!_

_–Jason_